U.S. Federal Housing is boosting the conforming loan limits by 3.26% for 2026 based on the annual change in home prices using an expanded data set.

The new limit of $832,750, is an increase of $26,250 from the 2025 limit of $806,500. The high-cost ceiling for one-unit properties will be $1,249,125, which is 150% of the new limit. This will also be the baseline limit for Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

The Federal Housing Administration will set its program loan limits based on the new conforming amounts.

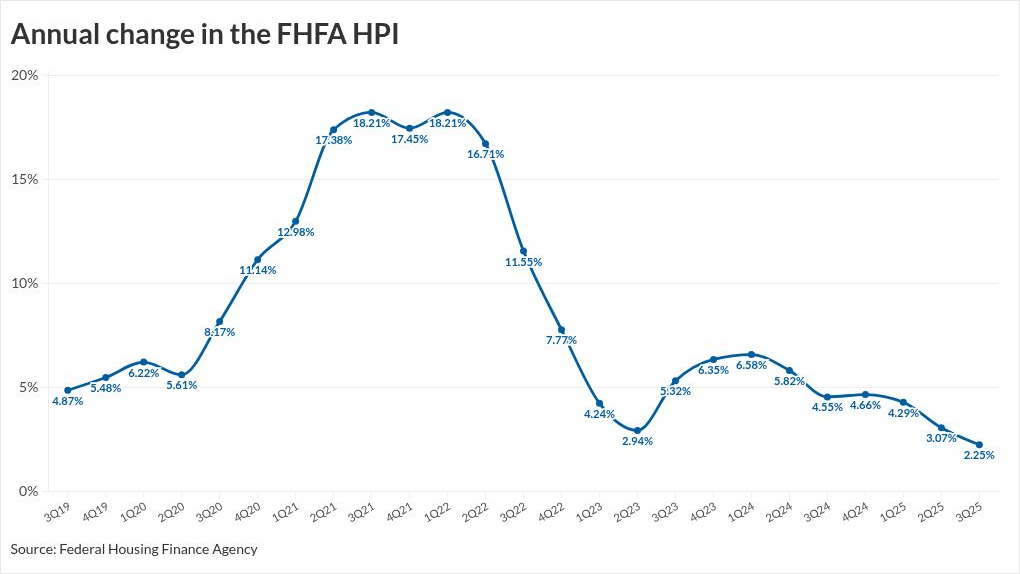

Earlier in the day, U.S. Federal Housing announced the Federal Housing Finance Agency House Price Index rose 2.2% year-over-year in the third quarter, following a 0.2% gain from the prior three-month period.

The third-quarter index sets the stage for the next year's conforming loan limits. U.S. Federal Housing builds on that figure with a broader data set that also pulls in numbers from the Federal Housing Administration and Cotality (formerly CoreLogic), according to an agency representative last year.

In the third quarter of 2024, the HPI increase was 4.3%; the expanded data allowed FHFA to raise the limits by 5.2% for the current year. But the expanded data set can also bring the final amount lower. For the third quarter of 2023, the HPI rose 5.5% but the 2024 conforming limit increase was just 5%.

As has become the practice in recent years, several well-known lenders are offering what they call conforming mortgages at next year's projected limits in advance.

Rocket is accepting loans at $825,500, while United Wholesale Mortgage, Rate, Crosscountry and Pennymac are at $819,000. The Rocket limit is 2.3% above the current conforming loan limits of $806,500.

House prices rose in 44 states and the District of Columbia and in 76 of the 100 largest metropolitan areas over the previous four quarters.

This quarter's annual increase is the second time under 3% since the second quarter of 2012 when the growth rate was 2.5%, and the lowest since the first quarter of that year, when prices were essentially flat.